st louis county sales tax rate 2020

Louis County Missouri Tax Rates 2020. The 2018 United States Supreme Court decision in South Dakota v.

Tim Fitch Chieftimfitch Twitter

Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law.

. The County sales tax rate is. The sales tax jurisdiction name is St. Tax rate 2020 tax rates for 2020 school districts all political subdivisions page 1 of 1155.

Average Sales Tax With Local. There is no applicable county tax. This is the total of state county and city sales tax rates.

RES COMM AGRI PP STATE OF MISSOURI 00300 00300 00300 00300 ST. Louis which may refer to. There are a total of 456 local tax jurisdictions across the state collecting an average local tax of 2806.

Statewide salesuse tax rates for the period beginning October 2020. 052021 - 062021 - PDF. School districts res comm agri pp 101 affton school district 51432 59764 00000 61569.

Louis Sales Tax is collected by the merchant on all qualifying sales made within St. Louis County Missouri Tax Rates 2020. In the City of St.

The current total local sales tax rate in Saint Louis County MO is 7738. Louis county 04430 04670 03980 05230 st. The Missouri state sales tax rate is currently 423.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. The Saint Louis sales tax rate is. 102020 - 122020 - PDF.

Louis county 04430 04670 03980 05230 st. Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax.

042021 - 062021 - PDF. LOUIS COMMUNITY COLLEGE 01987 01987 01987 01987 SPECIAL SCHOOL. 052020 - 062020 - PDF.

Saint Louis County MO Sales Tax Rate. The main difference in St. Louis residential properties are taxed at a rate of 19 commercial properties are charged 32 and agricultural properties are charged 12.

This is the total of state and county sales tax rates. Statewide salesuse tax rates for the period beginning July 2020. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. Louis community college 01987 01987 01987 01987. School districts res comm agri pp 101 affton school district 51432 59764 00000 61569.

There is no applicable county tax. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. The St Louis County sales tax rate is.

Louis County Sales Tax is collected by the merchant on all qualifying sales made. The minimum combined 2022 sales tax rate for Saint Louis Missouri is. The December 2020 total local sales tax rate was 7613.

Over the past year there have been 73 local sales tax rate changes in Missouri. The December 2020 total local sales tax rate was also 9679. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 35. Ad Lookup Sales Tax Rates For Free. The Missouri sales tax rate is currently.

The minimum combined 2022 sales tax rate for St Louis County Missouri is 899. Statewide salesuse tax rates for the period beginning November 2020. Louis county each municipality ie Clayton Kirkwood is assigned a tax rate.

This is the total of state and county sales tax rates. Statewide salesuse tax rates for the period beginning May 2021. LOUIS COUNTY 04430 04670 03980 05230 ST.

The Minnesota state sales tax rate is currently. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

072021 - 092021 - PDF. Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. Interactive Tax Map Unlimited Use.

State Muni Services. Statewide salesuse tax rates for the period beginning July 2021. Louis City and county real estate tax assessments is who pays what.

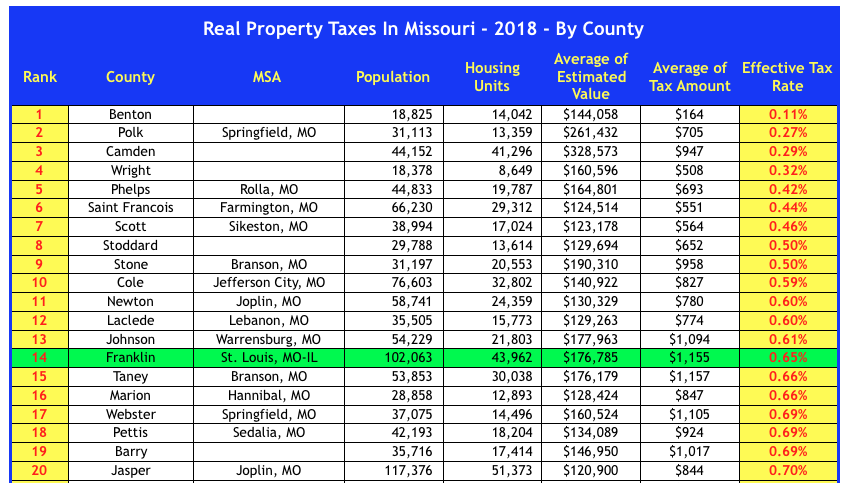

The St Louis County Sales Tax is 2263. Louis County Missouri Tax Rates 2020. Tax rate 2020 tax rates for 2020 school districts all political subdivisions page 1 of 1155.

This page will be updated monthly as new sales tax rates are released. Statewide salesuse tax rates for the period beginning October 2021. Louis community college 01987 01987 01987 01987.

072020 - 092020 - PDF. What is the sales tax rate in St Louis County. Heres how St Louis Countys maximum sales tax rate of 9988 compares to other counties.

Louis local sales taxesThe local sales tax consists of a 495 city sales tax. The St Louis County sales tax rate is 226.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

E Commerce Retail Sales As A Percent Of Total Sales Ecompctsa Fred St Louis Fed

Missouri Sales Tax Small Business Guide Truic

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Missouri Sales Tax Rates By City County 2022

Sales Tax On Grocery Items Taxjar